Here's a new Biden administration attack on small business that hasn't received enough attention

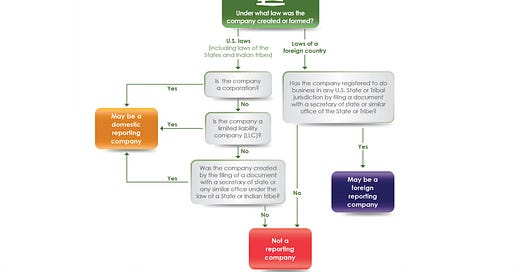

The government is here to help. Just follow this simple flow chart above.

A new federal regulation, effective on Jan. 1, dumps a new load of paperwork on Americans that’s sure to sink many small businesses.

Virtually every business in America, except for some big surprises now must report everyone who directly or indirectly who owns or controls the company. The purpose is to smoke out anonymous owners who might be using the company for money laundering, drug trafficking, terrorism and other illegal activities.

Sounds reasonable and simple, doesn’t it?

It’s not. The new Beneficial Owner regulation, issued under the Corporate Transparency Act, is confusing, complex, time-consuming and costly. Burdensome enough that businesses operating on small profit margins will find themselves broke.

But, it’s a boon for lawyers, accountants and expert consultants who find small business operators pounding on their doors for advice about how to navigate this nightmare,

The House Transportation committee said:

The Treasury Department and the Financial Crimes Enforcement Network (FinCEN), have transformed a simple-to-follow filing system into a complex maze that heavily strays from Congress’ intent and burdens small businesses.

Every single small business in America will be forced to comply with these new, onerous, and overly complex regulations by submitting detailed reports that include their owners’ sensitive personal information or face civil and criminal penalties.

You’ll say, well, the committee is controlled by Republicans, so what else do you expect?

Except that when you look beyond the regulation’s purpose and dig into the details, its’ a locomotive rushing down the tracks to crush the type of businesses that are the life-blood of the American economy.

Ryan Gardner, partner at Howard & Howard Attorneys, told the Chicago Sun-Times that the regulation is “…a radical shift from what has been required in the past.” He added, “This will impact just about every small business in Chicago.”

Indeed, Deputy Secretary of State Scott Burnham told the newspaper that he estimated up to 900,000 small and midsize businesses in Illinois may be affected by the law.

To get an idea of much work involved, here’s the Treasury Department’s Financial Crimes Enforcement Network’s (FCEN) 1,612-word guide to frequently asked questions. That’s just a listing of the links to the answers. The actual answers themselves consume a 16,905-word, 56-page document, not counting the many “helpful” flow-charts diagrams (see above and below), issued just 14 work days before the regulation took effect. Surely plenty of the 33.2 million small businesses in America had the time to figure it all out. (Please follow the link to the guide to get an idea of what’s involved.)

Speaking of that, only 34.6 percent of small businesses survived to the 10-year mark, an indication of the perilous task of running one. And this was probably over-looked by the Biden administration: almost 1 in 5 of small businesses are minority owned. So much for the administration’s claim that only it knows what’s good for minorities.

Helpful info from the government:

D. 4. What is an ownership interest?

An ownership interest is generally an arrangement that establishes ownership rights in the reporting company. Examples of ownership interests include shares of equity, stock, voting rights, or any other mechanism used to establish ownership.

So who is exempt from this reporting requirement? Am I? Not now that I’m retired. But back then I was a freelancer having my own limited liability company. I tried to wade through regs, but I can’t be certain. I drowned in a deep sea of gobblygook. As a last ditch, I was advise to go to the FinCEN’s Small Entity Compliance Guide that turned out to be 50 pages of bafflegab.

I loved this from the FAQs “Are certain corporate entities, such as statutory trusts, business trusts, or foundations, reporting companies?” The answer: “It depends” What it depends on is a couple hundred words of presumed explantation that only a lawyer or accountant would understand.

If you still don’t understand what it depends on, the guide advises you to go to: “Chapter 1 of FinCEN’s Small Entity Compliance Guide (“Does my company have to report its beneficial owners?”) may assist companies in identifying whether they need to report.” There, you sink deeper into the muck.

Do you think that the Biden family will have to discuss the full beneficial ownership of all those off-shore accounts?

By the way, TCEN’s guide explains that you, the public, can’t see the gathered data. But federal, state, local, and Tribal officials can. Oh, and “certain” foreign officials whose request is approved. Financial institutions too, “in certain circumstances”—all undefined.

Here’s the “big surprise” I promised earlier. You don’t have to report if you are one of the FCEN’s exceptions. There are 23, exceptions, as the FCN explains:

23 types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

Here are some: Banks and credit unions. Governments, and public utilities. Stock brokers, investment advisers, insurance companies, accounting firms, tax-exempt entities and “Large operating companies,” which I assume are large companies.

I appears that certain industry lobbyists got there to claim there exemptions before the small fry. I couldn’t find an explanation for why the 23 kinds of businesses were selected for exemptions. I’ll leave you to guess why.

Not included on the list are, for example, are barber shops, family-owned landscape companies, groceries, carpenters and other subcontractors, sole proprietors like free lance writers, and more.

If I were, for example, a small family owned home builder with, say, 100 employees, my accountant would have to be skilled enough to wade through this muck. But it’s not likely that such a small business would have one. Instead, I’d have to go to an outside consultant whose expertise is very specialized and very expensive. Already you can find an array of firms like Dunn & Bradstreet, that offer a helping hand.

But I will need to be careful. The earlier mentioned attorney, Ryan Gardner, warned Sun-Times readers of a “big possibility for a massive scam movement.”

Here are the dangers:

If you receive any emails, letters or phone calls asking you to share your information to comply with the new regulations, they most likely are fraudulent. You should not click any links or scan any QR codes. The Financial Crimes Enforcement Network does not send unsolicited requests.

The Better Business Bureau issued a warning that scammers are exploiting the new law to convince business owners to give up their personal information. You might receive legitimate-seeming messages with personal details obtained from data leaks and official-looking seals and watermarks.

Overlooked is how this regulation will require more bureaucrats and computer power to process and analyze all this data. We’ll probably never know how many, but be assured it won’t reduce our national debt.

So, here’s a summary: We don’t know who exactly must file the report. But we do know that compliance is time-consuming and costly, especially if you need outside expert advice. Certain industries—mainly financial and government busy-bodies of all stripes—escape having to file the information. About 90 percent of small businesses don’t know about the new requirements, so they have to quickly find competent help. Scamers, posing as experts already are gearing up their efforts.

Lastly, most Americans don’t realize this major change is occurring. It’s dry technical stuff. But be assured the inflationary costs of this major government intrusion, will be passed on to all Americans.

Dennis Byrne is a retired Chicago journalist, author and freelance writer. email: dennis @dennis byrne.net

hopefully the "Chevron Deference" case will end this bureaucratic dicta